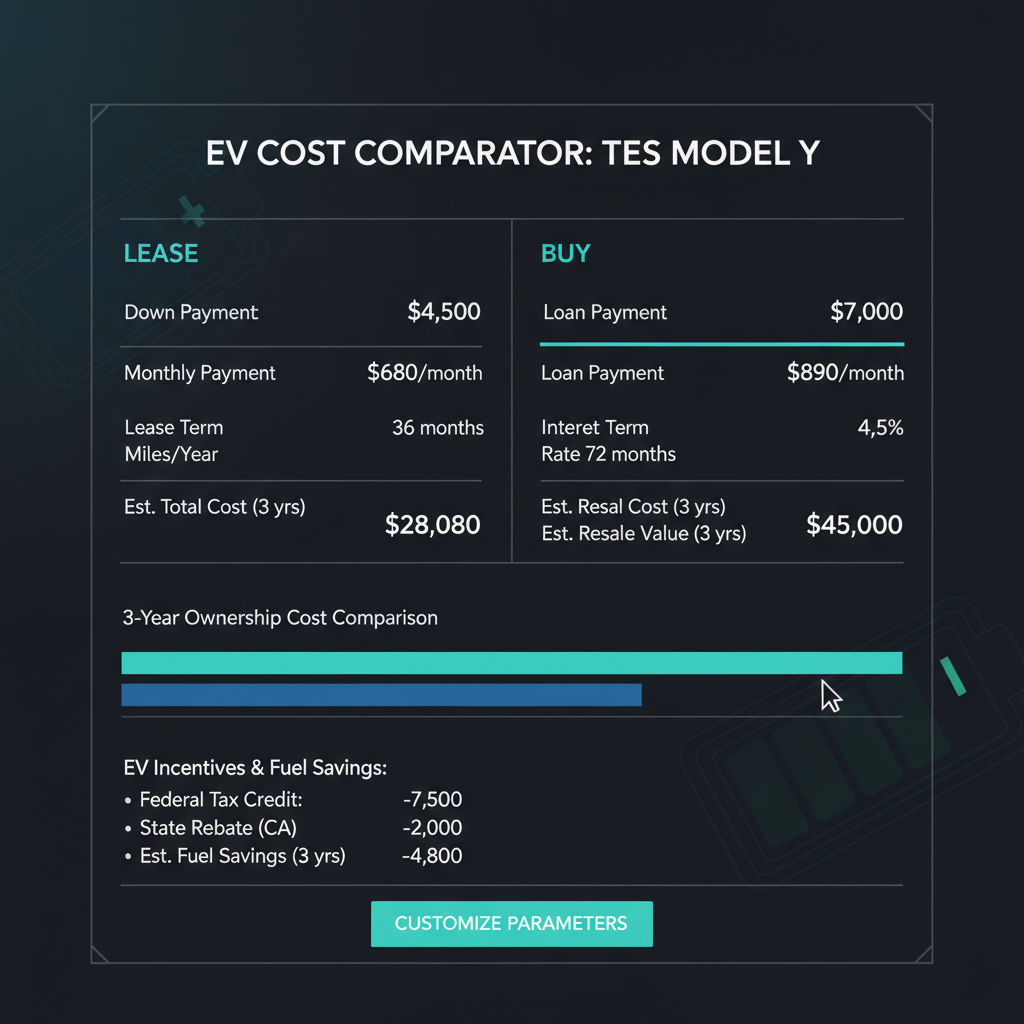

EV Lease or Buy in 2025? The Calculator That Reveals Shocking Tax Credit Loopholes and Resale Landmines

🔒

Contents

Premium Content Locked

This exclusive content requires viewing a short video advertisement to unlock.

Contents

This exclusive content requires viewing a short video advertisement to unlock.